Think of a small business budget template as your company’s financial command center. It's a living document that lays out your income and expenses, giving you a clear picture of where your money is coming from and, more importantly, where it's going. This isn't just about crunching numbers; it's about making smarter, more strategic decisions for your business's future.

A Practical Small Business Budget Template

Manage all your social media in one place with Postiz

Why a Budget Is Your Business Roadmap

Let's be real—the word "budget" doesn't exactly scream excitement. For many, it feels restrictive. But in the world of small business, a budget is the complete opposite. It's your key to freedom and growth, turning vague ambitions into a concrete, step-by-step plan.

Your budget is the GPS for your business. Flying blind without one means you’re just reacting to problems as they pop up, from surprise expenses to sudden cash flow shortages. A solid budget lets you see the road ahead, so you can anticipate challenges, seize opportunities, and navigate any economic bumps with confidence.

Gain Control and Make Confident Decisions

A well-organized budget template gives you an at-a-glance view of your financial health. This kind of clarity is priceless. Suddenly, decisions aren't based on gut feelings anymore—they're backed by hard data.

Wondering if you can afford that new hire or invest in a critical piece of equipment? Your budget has the answer. By knowing your exact monthly overhead and cash flow, you move from hoping for the best to planning for success. This proactive mindset is what separates thriving businesses from those that struggle with constant cash flow emergencies.

A budget is telling your money where to go instead of wondering where it went. It’s the difference between being a passive observer of your business's finances and an active architect of its future.

Plan for Sustainable Growth

Beyond day-to-day management, your budget is a powerful tool for mapping out your long-term vision. By earmarking funds for specific growth projects—like a new marketing campaign or product development—you create a tangible path to hitting your biggest goals.

Here’s how a budget directly fuels your growth:

- Strategic Spending: It forces you to get serious about priorities. You'll quickly see what's delivering a real return on investment and what's just draining your bank account.

- Securing Funding: Walking into a bank or meeting with an investor without a detailed budget is a non-starter. It’s the first thing they'll ask for because it proves you're financially responsible and have a credible plan.

- Improved Efficiency: Tracking every dollar helps you spot waste. You might realize a certain advertising channel isn't performing, allowing you to shift that money to something that works. To dig deeper into this, check out our guide on small business marketing automation.

Putting the Financial Puzzle Pieces Together

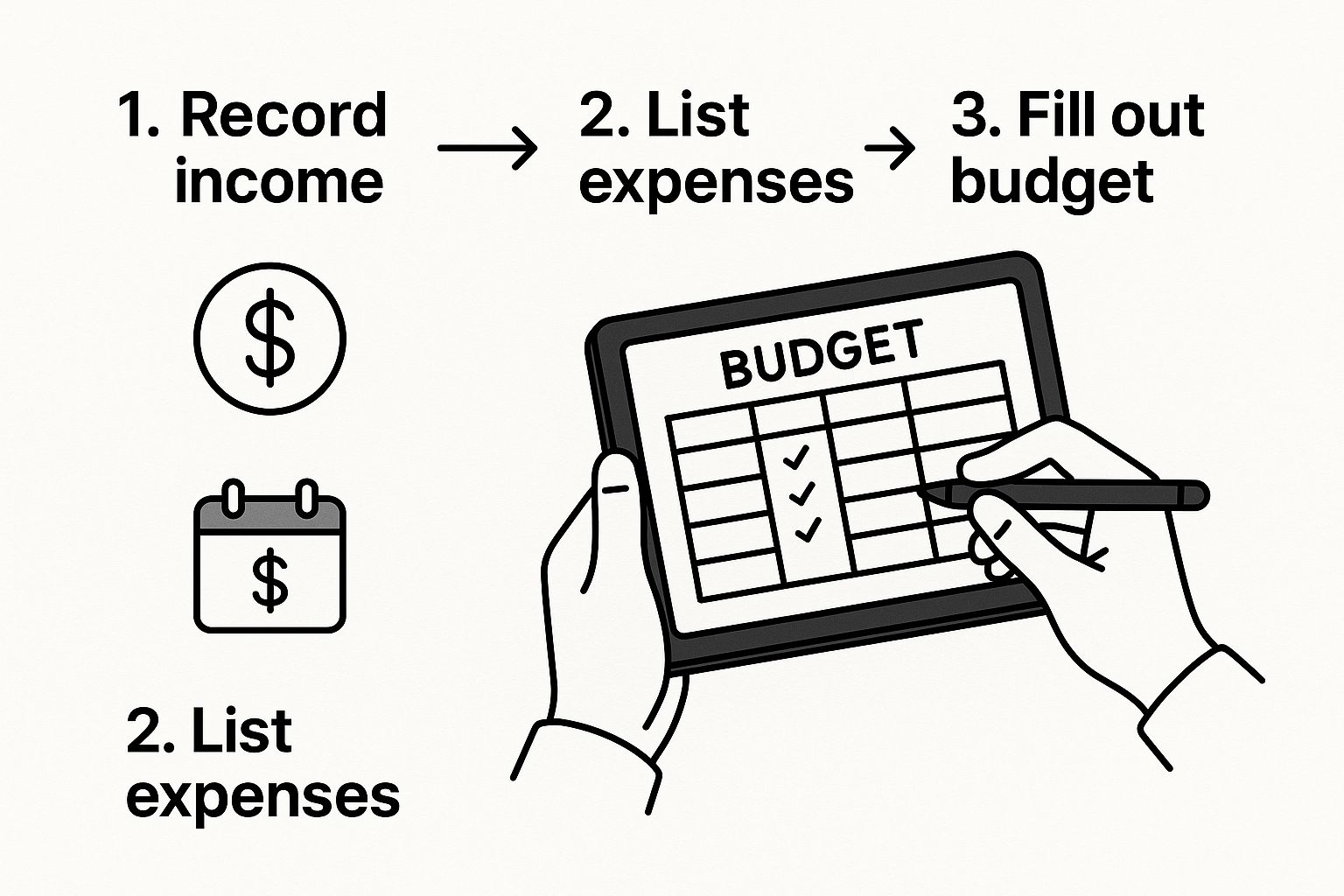

Before you can even think about plugging numbers into a template, you've got to gather all your financial data. I like to think of it as dumping all the puzzle pieces onto the table. You can't see the big picture until you know what you're working with. This first step is absolutely vital for creating a budget that's actually useful.

Your best bet is to start digging into your past financial records. Pull up your bank statements, credit card bills, and old invoices—these are your treasure troves of information. They give you a real, hard-data history of your cash flow, showing exactly where your money came from and where it went.

Tally Up Your Income Streams

First things first, make a list of every single way your business makes money.

If you run a local coffee shop, for example, your income streams might be in-store sales, merchandise, and maybe wholesale beans you sell to other businesses. A freelance graphic designer would list out income from different client projects and ongoing retainer contracts. The key here is to avoid guessing. Use the real numbers from your records to get an honest starting point.

Get a Handle on Your Expenses

Next, it's time to sort out your spending. I find it easiest to break everything down into two main categories: fixed and variable costs.

- Fixed Costs: These are the expenses you can count on every single month, no matter how busy you are. We're talking about things like the rent for your storefront, your website hosting, insurance payments, and any loan repayments.

- Variable Costs: These costs go up and down depending on your business activity. For that coffee shop, this would be the cost of milk and coffee beans. For the designer, it might be ad spend or a subscription to a stock photo site they only use for certain projects.

Getting a clear view of your expenses is non-negotiable, especially when you're just starting out and every dollar feels precious. It's a reality for most of us entrepreneurs.

This is especially true when you consider that 64% of small businesses in the US kick off with $10,000 or less. That stat alone shows just how critical careful financial planning is right from the get-go.

To really get this right, you need to master small business cash flow management so you have a firm grip on the money moving in and out. Once you have all this data laid out, you're finally ready to build a budget that reflects what's really happening in your business.

Building Your Budget Template from Scratch

Staring at a blank spreadsheet can feel a little intimidating. I get it. But instead of seeing an empty grid, think of it as a clean slate for your business's financial future. We're going to build a tool that tells the story of your money—where it comes from, where it goes, and how you can make smarter decisions with it.

The key to a truly useful budget isn't just listing numbers; it's about creating a dynamic comparison. For every single line item, you'll want two columns sitting side-by-side: ‘Projected’ and ‘Actual’. This simple setup is the secret sauce. It immediately shows you the difference between what you planned to happen and what really happened.

Structuring Your Income and Expenses

Let's start with the fun part: the money coming in. At the very top of your spreadsheet, create a section for all your income streams. If you’re a freelance writer, for example, you might have separate lines for "Project Work," "Retainer Clients," and maybe even "Affiliate Income." Add them all up for a ‘Total Projected Income’ each month.

Now for the expenses. To keep things from becoming one long, confusing list, you need to group your costs into logical categories. This makes your budget so much easier to understand at a glance.

Here's a simple way to break it down:

- Fixed Costs: These are the bills you can count on every single month, like clockwork. Think rent for your office, software subscriptions (like your accounting or design tools), insurance premiums, and loan payments. They’re predictable.

- Variable Costs: These expenses go up and down depending on how busy you are. This category includes things like raw materials for products, shipping fees, or your monthly ad spend. Having a clear social media marketing plan can really help you estimate these marketing costs more accurately.

- One-Time Costs: This is your catch-all for big, infrequent purchases. Buying a new laptop, investing in a website redesign, or paying for a professional development course would all fall in here.

A budget is just a plan for your money. That's it. The 'Projected' vs. 'Actual' columns turn that plan into a powerful feedback loop, showing you exactly where you nailed your estimates and where you need to recalibrate for next month.

This is what it looks like when you bring all these pieces together.

As you can see, organizing your finances with clear income and expense categories makes it much easier to track everything and take action.

To give you a clearer picture, here's a table outlining the essential components every small business budget should have.

Essential Components of a Small Business Budget

| Category | Sub-Categories (Examples) | Purpose |

|---|---|---|

| Income | Product Sales, Service Fees, Retainer Clients, Affiliate Revenue | Tracks all money coming into the business from various sources. |

| Cost of Goods Sold (COGS) | Raw Materials, Direct Labor, Inventory Purchases | Calculates the direct costs associated with producing your goods or services. |

| Fixed Expenses | Rent/Mortgage, Salaries, Insurance, Software Subscriptions | Accounts for predictable, recurring costs that don't change with sales volume. |

| Variable Expenses | Marketing/Ads, Shipping, Commissions, Utilities | Monitors costs that fluctuate with business activity and sales levels. |

| One-Time Expenses | New Equipment, Website Redesign, Professional Training | Budgets for significant, non-recurring investments in the business. |

This structure ensures you're not missing any critical financial details, giving you a complete view of your business's health.

Making It Work with Simple Formulas

You don't need to be a spreadsheet guru to make this template work for you. Let the software do the heavy lifting!

Use the basic SUM function to automatically total your income and each of your expense categories. Then, at the bottom, create a summary section. A simple formula—Total Income - Total Expenses—will instantly calculate your net profit or loss.

Doing this turns your static sheet into an intelligent financial dashboard. If you're looking for inspiration, checking out some sample budget templates to simplify finances can give you great ideas for how to structure your own, even if they're from a different industry.

Using Your Budget to Forecast the Future

Your new budget template isn't just a rearview mirror for your spending. It's your financial crystal ball. A good budget is a living document that helps you look ahead, plan for growth, and make smart decisions based on real data—not just a gut feeling.

This is where forecasting comes in. It turns your budget from a simple tracking sheet into a powerful planning tool. You can start preparing for what's next, whether that's a slow season you need to weather or a huge growth opportunity you want to jump on.

From Hindsight to Foresight

The easiest way to get started is by looking at what you've already done. Let's say you look at your sales from the last quarter and see a steady 5% increase each month. It’s a pretty safe bet to project a similar trend for the next quarter, as long as nothing major changes in your market.

That simple projection gives you a baseline for what revenue might look like, which helps you plan your expenses with a lot more confidence.

But the real magic happens when you start running ‘what-if’ scenarios. This is where your budget spreadsheet becomes your playground for big decisions. Before you pull the trigger on a major move, you can see how it'll play out financially.

Think about these common situations:

- Hiring a new employee: What does adding another salary, plus benefits and payroll taxes, do to your profit margin?

- Buying new equipment: How will that big, one-time purchase impact your cash flow over the next six months? Can you handle it?

- Hitting a sales slump: If revenue suddenly drops by 10%, which variable costs can you cut back right now to protect your business?

When you run these what-if scenarios, you take the surprise out of financial challenges. They become manageable events you’ve already planned for. You're no longer just reacting—you're being strategic.

This kind of proactive thinking is what separates businesses that thrive from those that just survive. For example, recent surveys show that while 75% of small business owners feel good about the future, a whopping 80% are still worried about inflation. Forecasting with your budget is how you navigate those pressures with a solid plan.

You can find more data on this in the small business economic outlook at Tailor Brands. This approach makes your budget one of the most important guides you have for building a business that lasts.

How to Review and Adjust Your Budget

Getting your business budget template built is a fantastic first step. But here’s the secret: the real magic happens when you treat it like a living, breathing part of your business. A budget isn’t a one-and-done document you file away. It's a dynamic tool that needs regular attention to keep your business on track.

When you're just starting out or going through a growth spurt, I’d recommend a monthly review. As things stabilize, you might find that a quarterly check-in is plenty. The key is consistency—it helps you spot small problems before they snowball.

Analyzing Your Budget Variances

The most critical piece of any budget review is looking at your variances. That’s just a fancy word for the difference between what you thought you’d spend or earn ('Projected') and what actually happened ('Actual'). This is where the story of your business unfolds.

Don't just glance at the numbers. Ask why.

Let's say your marketing costs were 15% over budget. The real question isn't just about the overspend; it's about the return. Did that extra investment bring in more leads or sales? This is where understanding your media engagement metrics becomes incredibly valuable. If the answer is yes, maybe that higher spend is the new normal. If not, it's time to re-evaluate that strategy.

This kind of analysis transforms your budget from a simple accounting sheet into a powerful decision-making guide. You start to see what’s truly driving growth and where you can pull back.

Your budget review is the feedback loop for your business. It's where you learn from the past to make smarter choices for the future, ensuring your financial plan evolves right alongside your company.

This discipline of regular adjustment is more than just good practice—it's essential for survival. Around 50% of new small businesses don't make it past five years, often due to financial missteps. You can read more about small business success rates at Bizplanr. Keeping a sharp eye on your budget is one of the best ways to build a resilient company that can adapt and thrive.

Got Budgeting Questions? We’ve Got Answers.

Even with a solid template in hand, you're bound to have questions. Financial planning can feel a bit like navigating a new city, and it's totally normal to hit a few confusing intersections. Let's clear up some of the most common hurdles I see business owners run into.

A big one is always, "How detailed do I need to be?" It's tempting to track every last paperclip, but that's a fast track to burnout. The goal here is clarity, not getting bogged down in minutiae.

My advice? Start with broader categories like "Office Supplies" or "Marketing Tools." If you notice one of those categories creeping up in cost, then you can dig deeper to see what's driving the expense.

What’s the Best Format for a Small Business Budget?

People often wonder if a simple spreadsheet is really enough. The answer is a resounding yes.

For most small businesses just getting their sea legs, a spreadsheet is your best friend. It’s incredibly flexible, you don’t need fancy software, and it gives you total control. You can easily set up columns to compare what you planned to spend versus what you actually spent, which is where the real learning happens.

The best budget format is the one you’ll actually stick with. A complex, expensive software you ignore is useless compared to a simple spreadsheet you look at every week.

How Often Should I Actually Look at This Thing?

This is crucial. A budget you create in January and forget about until December isn't a tool; it's a relic. Consistency is what turns this document into a powerful guide for your business.

When you're just starting out, a monthly review is non-negotiable. This helps you spot problems before they become disasters. Once your business finds its rhythm and cash flow is more predictable, you might shift to a quarterly review.

- Monthly Check-ins: Perfect for course-correcting on the fly. Did you overspend on ads? Underspend on software? This is your chance to adjust for next month.

- Quarterly Reviews: Great for spotting bigger-picture trends and planning for the upcoming quarter. Are your seasonal sales patterns matching your predictions?

Think of it this way: your budget isn't meant to be a static document set in stone. It's a living, breathing guide that helps you make smarter decisions as you grow.

Ready to take control of your content strategy? With Postiz, you can schedule, analyze, and create stunning social media posts all in one place. Simplify your workflow and grow your business by visiting https://postiz.com to get started today.

Founder of Postiz, on a mission to increase revenue for ambitious entrepreneurs

Do you want to grow your social media faster?

Do You Want to Grow Your Social Media Faster?

Thousands of creators and businesses use Postiz to 10x their social media reach. Stop spending hours — automate and grow.

Related Posts

Discover 10 actionable community building strategies for social media. Learn to foster engagement, loyalty, and growth with our expert guide for creators.

Want to know can you schedule tweets? Yes. This guide walks you through the best methods for scheduling on X to save time and boost your engagement.

Learn how to share Facebook videos step by step. Discover the best ways to post to your feed, Stories, groups, Messenger, and Pages.

Ready to get started?

Grow your social media presence with Postiz.

Schedule, analyze, and engage with your audience.

Open-source social media scheduling tool